Who we are

We believe that transaction monitoring could be better, smarter and intelligent.

By using AI or Machine Learning models, financial institutions will be able to better detect fraud and discover money laundering (patterns) earlier. It will strengthen their power in the fight against financial crime. When using the right tools, it will also reduce the workload for analysts.

With deep roots in AI/ML and regulatory compliance for banks and payment processors, we have obtained a profound understanding of the challenges FI’s face in fraud and AML. So we’ve built our technology to plug into and enhance their existing environment, thereby strengthening both legacy systems and modern (cloud) architectures.

Sygno is the second wave of Regtech in transaction monitoring, we believe in collaboration, simplicity, and openness.

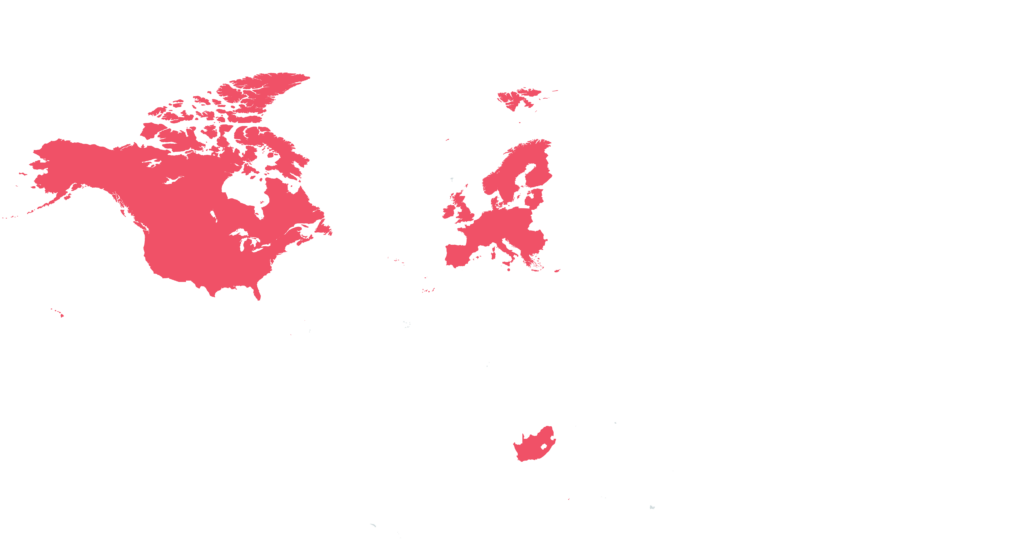

Where we are active