Free up your analysts

Eliminate False Positives by modeling good client behavior, allowing analysts to focus on critical cases.

Cost-effective monitoring

Make your Transaction Monitoring more cost-effective with our effective and easy to integrate AML or Fraud models.

Easy implementation

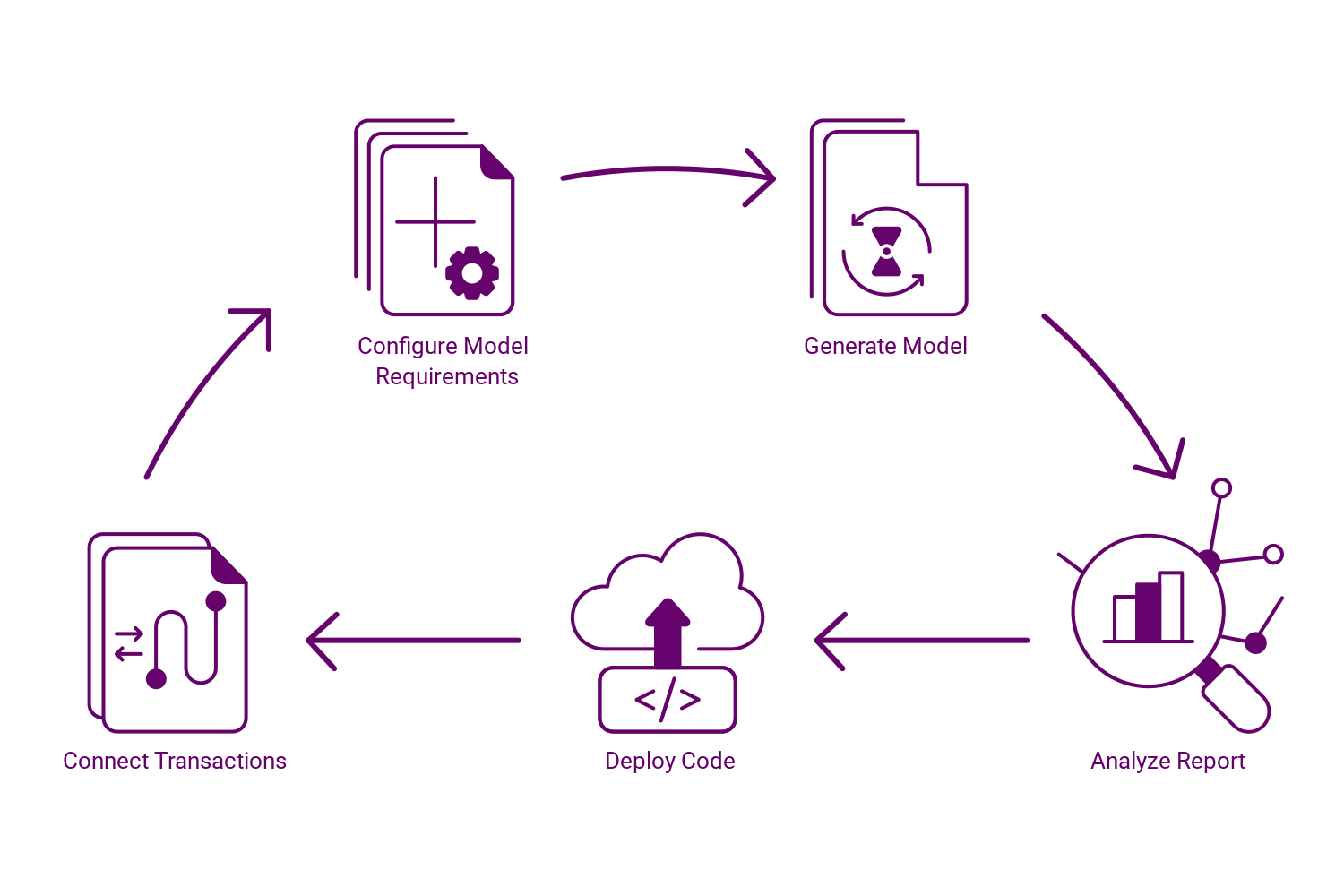

Our solution generates explainable and transparent AML or Fraud models, in the code language needed for your Transaction Monitoring system.

This is how it works

Know good, catch bad

Struggling with excessive False Positives? Can’t catch all suspicious transactions with your existing system? Traditional banking rules can no longer keep up with the sophisticated techniques used in money laundering and fraud. Learn how we deal with these challenges for you by watching our video.

Eliminate around 80% False Positives

Catch up to 300% more financial crimes

Improve efficiency updating/training models by 90%

AI models for Anti-Money

Laundering (AML) and fraud

At Sygno, we model the good behavior of your customers to highlight bad behavior, making Transaction Monitoring more efficient and effective.

Sygno’s leadership has decades of experience in Risk and Compliance

With our industry expertise and extensive experience in implementing Transaction Monitoring systems, we can provide a tailored solution for your TM environment of choice. Sygno offers transparency for the risk owner, (AML) compliance officer, auditors and regulators.

Ready to enhance your Transaction Monitoring process?

Contact us today for a free consultation and discover how our advanced Machine Learning model can boost your AML and Fraud detection.